Table Of Content

For this reason, preapproval letters are more meaningful than pre-qualification letters, but they also take longer to receive. And, like pre-qualification letters, preapproval letters are still not a guaranteed loan offer. A pre-qualification letter is a document that lenders issue outlining how much it’s willing to lend based on a borrower’s self-reported financial information. Prospective homebuyers can use a pre-qualification letter to demonstrate their financial strength—and the likelihood they’ll be approved for a mortgage—to sellers. For that reason, pre-qualification letters typically accompany offers to buy property—especially when closing is contingent on the buyer’s ability to secure financing.

How to increase your prequalified loan amount

The city has a laid-back vibe, with a strong focus on health and wellness, with activities such as hiking, surfing, and cycling. But if you’re looking for more affordable options, you’ll want to check out affordable San Diego suburbs. Requires an estimate but no proof of your credit, debt, income and assets. Find out how much house you can borrow before you start looking – and how you can make the strongest offer possible on the property you choose.

What Is Mortgage Pre-qualification?

A preapproval can give you a much better idea of how much house you can truly afford, so even if your agent doesn't require you to get one, it’s still generally a good idea. Because a mortgage preapproval involves a deeper review of your finances, a preapproval letter carries more weight than a prequalification letter. In fact, you generally need a preapproval before you can even make an offer on a house. A prequalification letter won’t work at this stage because your finances need to be verified. If you aren’t happy with the prequalified offers you receive, consider adjusting your desired loan amount or repayment terms.

Can I afford a house in California?

The lender may also verify your history of making your rent or mortgage payments on time. You should consider prequalifying for a home loan as soon as you start thinking about buying a house. Prequalification gives you an estimate of how much you might be able to borrow based on your income, debts, and credit history.

How to Get a Mortgage

Pre-qualification is a good first step when you’re not sure whether you’re financially ready to buy a home. A mortgage pre-qualification is usually based on an informal evaluation of your finances. You tell the lender about your credit, debt, income and assets, and the lender estimates whether you can qualify for a mortgage and how much you may be able to borrow.

How To Buy A House With Bad Credit - Bankrate.com

How To Buy A House With Bad Credit.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced. Victoria Araj is a Section Editor for Rocket Mortgage and held roles in mortgage banking, public relations and more in her 15+ years with the company. She holds a bachelor’s degree in journalism with an emphasis in political science from Michigan State University, and a master’s degree in public administration from the University of Michigan.

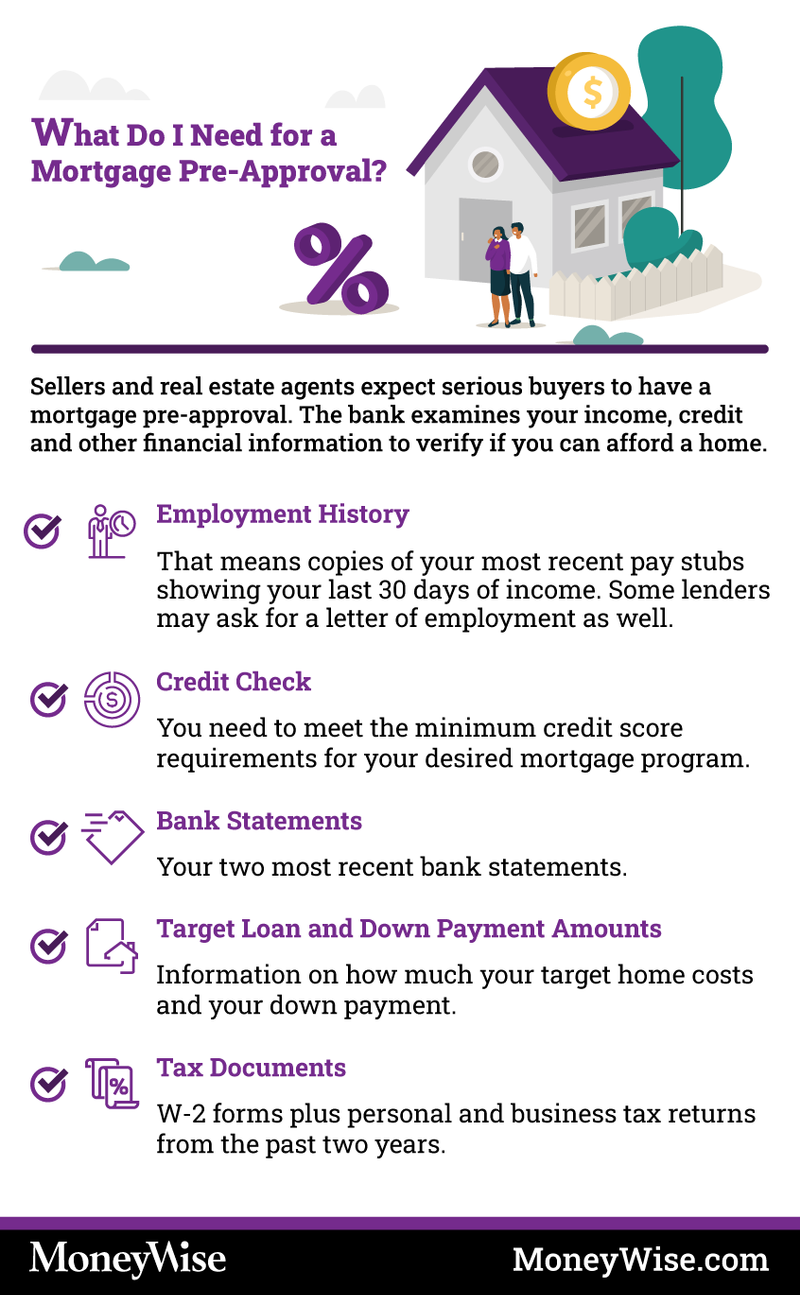

If you’re ready, apply early to see your mortgage loan options and show agents that you’re a serious buyer. When the time comes, they can also help you decide how much to offer and show the seller that you’re a serious buyer. Certain tax documents, including your two most recent W-2 forms, are also among the documents needed for mortgage preapproval. These documents are another way to verify your income and show how much was taken out for tax purposes.

As with any lender, down payment and closing costs may differ depending on the type of loan program you choose with Zillow Home Loans. Meanwhile, minimum down payments on conventional loans can be as low as 3%. As far as Zillow Home Loans closing costs are concerned, they tend to range between 3% to 5% of the loan amount. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market.

Contact more than one lender

If you’ve received money from a family member toward a down payment, be prepared to provide the lender with a signed letter from your relative that confirms the funds are not a loan. The lender may also ask for additional documentation, such as withdrawal and deposit slips. The credit score required to buy a house in California will depend on the mortgage loan you are applying for. Generally, a credit score of 620 or higher is considered a good score for a conventional mortgage loan. Government-backed loans such as FHA loans may accept lower credit scores, sometimes as low as 500.

Lenders rely on credit scores to assess your creditworthiness and determine the terms of your mortgage, including interest rates and loan options. A higher credit score generally indicates that you have a history of responsibly managing your debts, making you a more attractive borrower. A good credit score can increase your chances of mortgage approval and help you secure more favorable loan terms. Keep in mind that a home’s purchase price isn’t the only thing that impacts affordability. Your mortgage rate also plays a big role in determining how much house you can afford and what your monthly mortgage payment will be. This can include traditional banks, credit unions, and online lenders.

Only residents of the state of New York are ineligible to take out a mortgage loan from the online lender at this time. Mary Beth is a freelance writer for Newsweek’s personal finance team. She specializes in explaining the ins and outs of mortgages and other loans, helping people to use debt wisely and build their credit. Based in Pittsburgh, Pa., Mary Beth is a proud alumna of Bowling Green State University, where she volunteers on the board of the Falcon Media alumni group. This credit card is not just good – it’s so exceptional that our experts use it personally.

No comments:

Post a Comment